Mass Layoffs at SilencerCo

February 2, 2017While the past eight years have been especially stressful for gun owners, the unprecedented explosion in firearms sales that took place during President Obama’s two terms and the run-up to 2016’s elections was quite good for gun and accessory retailers and manufacturers. Since November though, the market has been quite a bit different. Following Donald Trump’s surprising victory in the presidential election, the bottom has dropped out of the firearms market and some companies are starting to feel the squeeze.

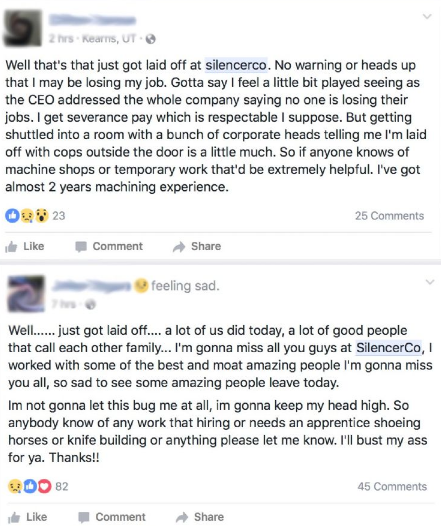

This evening, news started to leak from now-former SilencerCo employees that the company laid off a large, perhaps majority, portion of its workforce. According to the folks that were apparently let go, as much as 50% of the company was sent packing. The market is unquestionably in a major lull, but beyond slowed firearms and suppressor demand, I suspect a few previous decisions may be aggravating SilencerCo’s challenges.

First, SilencerCo let Mike Pappas (one of its founders and the company’s chief engineer) go in 2013. Mike was the brains behind incredibly successful cans like the Osprey series, the Sparrow, and the Saker line. Pappas’ departure also led Sales VP, Gary Hughes, to leave the company at the end of that year. Then in May of 2014, they followed up their 2013 performance by showing Henry Graham (former owner of SWR who joined SilencerCo after they acquired SWR) the door. Graham is well known for his work on the Octane pistol silencers, the Specwar series of rifle suppressors, and the Spectre/Warlock rimfire cans. Over a six month period, SilencerCo broke ties with the designers responsible for the vast majority, if not all, of their lineup.

Bad Decisions

The second significant piece here has to do with SilencerCo’s public break up with the suppressor industry’s top distributor, Silencer Shop, that took place just over a year ago. Silencer Shop’s volume makes up roughly 50% of all suppressor sales nationwide, so the move raised eyebrows at the time, but the magnitude of the damage wasn’t clear until then-President Obama and his ATF decided to move forward with proposal 41P/F last January. Shortly thereafter, Silencer Shop announced a revolutionary plan to handle the new fingerprinting and photo requirements that were to be imposed on members of trusts and other legal entities. When the changes went into effect in July, SilencerCo was left out as other companies took advantage of Silencer Shop’s system and continued to sell in relatively steady volumes. Now that silencer sales have slowed, its more important than ever that manufacturers sell through as many channels as possible. SilencerCo’s rocky relationship with Silencer Shop isn’t helping.

Splitting with Silencer Shop shouldn’t have killed SilencerCo, though. After all, Mike Pappas’ new company, Dead Air, doesn’t sell through Silencer Shop and they seem to be doing just fine. The real issue here is that SilencerCo has been surpassed by many of its rivals. With Pappas at Dead Air and Graham now with Rugged Suppressors, SilencerCo essentially created two rivals when they let those two gentlemen go. Both companies offer direct competitors to SilencerCo’s products. The market has changed as well. In the last two years, silencers have gotten substantially lighter, more modular, and mounting systems have improved significantly. SilencerCo is still selling effectively the same suppressors they offered back in 2013, with a few noteworthy, but not “game changing” additions. Their most exciting new product (subjectively speaking), the Maxim 9, isn’t set to hit shelves for another month or so and even when it does, its market will be far more limited than many will want to admit. Stagnation is quite literally killing SilencerCo and it isn’t clear at this point if they still have the people on board to stir things up.

Political Uncertainty

The next few months will be interesting for the firearms market as a whole, but especially for the suppressor industry. There’s no doubt that several organizations hired and tooled up to meet pre-41F and pre-election demand. That run has come to an end and the new, bearish market will certainly test businesses all over the industry.

Meanwhiile, the industry and enthusiasts have mounted a full-court press on Congress to pass the Hearing Protection Act. These renewed efforts began when the new session started early last month, but even if the bill is successful, it’ll be many months before the changes take effect. Some potential buyers have chosen to take a wait-and-see approach with the HPA, pausing new purchases in hopes that suppressor regulations will be loosened in the near future. That inactivity is adding to the post-election slowdown and further straining the market. Until these market conditions change (and at some point they most definitely will), companies like SilencerCo are going to be facing some very difficult decisions. It’ll be interesting to see if other manufacturers try to hold tight or if they’ll follow SilencerCo in downsizing.

An information security professional by day and gun blogger by night, Nathan started his firearms journey at 16 years old as a collector of C&R rifles. These days, you’re likely to find him shooting something a bit more modern – and usually equipped with a suppressor – but his passion for firearms with military heritage has never waned. Over the last five years, Nathan has written about a variety of firearms topics, including Second Amendment politics and gun and gear reviews. When he isn’t shooting or writing, Nathan nerds out over computers, 3D printing, and Star Wars.